Incubation Centers & IT ParkThe HEC mandated all Higher Education Institutes (HEI) establish Offices of Research, Innovation, and Commercialization (ORICs), which led to the establishment of the Business Incubation Centers (BICs). Pakistan’s HEC supports and encourages HEIs to establish BICs to strengthen the link between academia and industry.

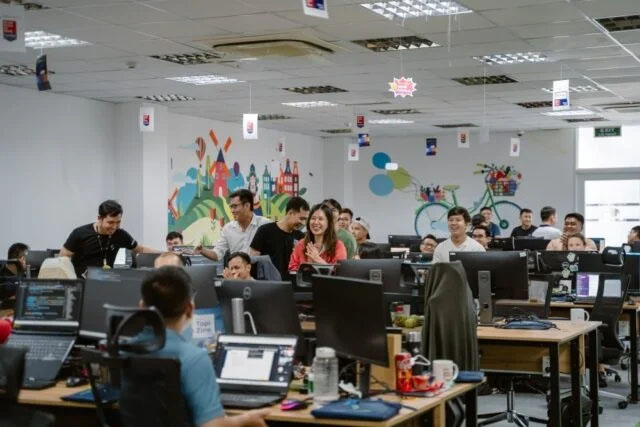

Software Development HousePakistan’s market for computer software has seen steady growth for the past several years. According to local industry sources, the total size of the software sector is approximately $3.2 billion, which is expected to grow despite challenges posed by the business environment and macroeconomic challenges.

The local software market offers substantial business opportunities for UK companies who offer products for the corporate sector including financial management and business forecasting, online IT training portals, e-commerce, e-payment, embedded tools, and other web-based applications. Industry experts have expressed optimism about growth prospects in the e-commerce sector, projecting $1.6 billion in revenue by 2023. Increased use of mobile wallets, coupled with cheaper and more accessible smartphones, has helped increase the user base for Pakistan’s e-commerce industry.

Manufacturing of Computers and PeripheralsDue to the global pandemic and prevailing domestic macroeconomic challenges, Pakistan’s market for computers and peripherals has seen a nominal growth trajectory during the last fiscal year. With virtually no domestic production, the country relies heavily on imports.

Sub-Sectors:

The most promising sub-sectors within Computers and Peripherals for FY 2024 are:

- Personal Computers (New/Used) Computer Laptops and Tablets (New/Used) Computer Networking Equipment Servers/Gateways

Opportunities:

Despite weak economic growth, the past year has seen a growing trend of computer users, especially, at home using used/refurbished computers and laptops. This has resulted in a large influx of used computers, both branded and unbranded, into the local market. This trend has had only a minor impact on available international brands; however, corporations still prefer new and branded equipment, and these corporations traditionally make up the bulk of the market.

CybersecurityPakistan’s market for cybersecurity equipment and services is at a developing stage and needs investment and technical expertise. With more than 100 million internet subscribers in both public and private sectors, the local market offers substantial business opportunities for the UK & European companies, as there exists a marginal presence of local and foreign companies having expertise in offering reliable service packages for the domestic cybersecurity requirements. Like other markets, the cybersecurity threats in Pakistan include hacking, identity theft, cyber-bullying, cyberstalking, spoofing, financial frauds, digital piracy, viruses and worms, malicious software, IPR violations, money laundering, denial of service attacks, electronic terrorism, vandalism and pornography.

Telecommunication Equipment and ServicesPakistan’s telecommunications industry has seen some growth lately, owing to the growing demand for reasonable telecom services. The country has witnessed an extensive expansion of mobile and broadband networks, and the government has taken significant steps to improve infrastructure and encourage competition.

Pakistan’s telecommunications infrastructure includes Microwave radio relay, coaxial cable, fiber-optic cable, cellular, and satellite networks. There are ten international submarine cable systems connecting Pakistan, including SMW3, SMW4, SMW5, IMEWE, AAE-1, TW1, PEACE, 2AFRICA, and AFRICA1 that provide links to Asia, the Middle East, Europe and Africa.

Telecommunication Equipment

The present market size for the import of telecommunication equipment (including handsets) is estimated at approximately $700 million. Chinese telecom infrastructure providers like ZTE and Huawei have established branches in Pakistan and are engaged in the design, development, installation, configuration, and maintenance of telecom installations. Other vendors of telecom equipment and services in Pakistan include Advance Digital, Inc., GD Satcom, iDirect, Comtech EF Data Corp., NEC Corporation, Conexant Systems, Agere Systems and Emerson Process.